How to digital signature your GST returns

In the era of Digital India, the country’s new Goods and Services Tax (GST), taking effect 1 July, modernizes how registered assessees sign and file their returns – online rather than by hand.

Digital signature already prevails with income tax returns and the Ministry of Corporate Affairs, and now the government is introducing digital signature and online filing for GST returns (GSTR) as well. It’s good news for registered dealers who, under GST, have to file as many as 36 returns a month if having business in all 29 states and 7 union territories. Manual signing and filing would simply be one more complication in what’s already shaping up to be a convoluted GST compliance process.

Digital signature already prevails with income tax returns and the Ministry of Corporate Affairs, and now the government is introducing digital signature and online filing for GST returns (GSTR) as well. It’s good news for registered dealers who, under GST, have to file as many as 36 returns a month if having business in all 29 states and 7 union territories. Manual signing and filing would simply be one more complication in what’s already shaping up to be a convoluted GST compliance process.

So how can companies take advantage of digital signature and online filing? It will all happen within the online GST Common Portal, for which all taxpayers need to register. Registration is free, and companies only need to register once for both state and central filing.

The GST Common Portal will allow businesses to designate employees as authorized signatories, which enables them to sign and file returns on behalf of the business, as well as to make payments – all online. Any person registered on the Authorized Person tab of the GST Common Portal for an enterprise can sign and file GSTR on behalf of that enterprise, using either digital signature certificates (DSC).

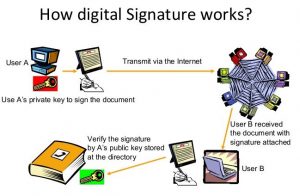

How digital signature works

How digital signature works

Digital Signature is linked to the Aadhar card of the signatory. It’s designed for small entrepreneurs, such as proprietors, who do not have digital signature certificates (DSC).

When filing a return within the GST Common Portal, authorized signatories click on “Digital Signature” and receive a prompt to enter their Aadhar number. This sends a request to the UIDAI system to generate a one-time password (OTP), which is then sent to the email address and mobile number associated with that Aadhar number. The user then inputs the OTP into the portal. If the OTP matches, the filing – or other action – is complete. Signing GSTR with e-sign is a quick and easy process compared to using digital signature.

All about Digital Signature Certificate (DSC)

A digital signature certificate replaces a hand-written signature in establishing the identity of someone online. Using digital signature certificates to sign and file returns in the GST Common Portal is mandatory for companies and limited liability partnerships (LLPs), and optional for other taxpayers.

A digital signature certificate is linked to the Permanent Account Number (PAN) of the signatory, whose PAN is encrypted in a DSC token. To obtain a DSC, signatories must provide a copy of their PAN and Aadhar cards (or other proof of address) to a Certifying Authority (CA), along with an application form and a nominal fee. The CA then issues the digital signature certificate with software that allows the digital signature to be installed on the user’s computer or on the business’ system.

After installing the token, the digital signature certificate needs to be registered within the GST Common Portal. This happens on the Register Digital Signature Certificate page.

During registration, the portal prompts the user to select the PAN of the person whose DSC is being registered from the list of authorized persons. The system then validates the PAN against the digital signature certificate. If it matches, the registration is complete, and the digital signature certificate can be used to sign and file online GSTR.

A digital signature certificate is typically valid for one to three years. Upon renewing a digital signature certificate, taxpayers will also need to update it within the GST Common Portal to ensure there are no interruptions in signing and filing returns digitally, as well as submitting payments on time.

Digital signing and filing of GSTR will all occur within the GST Common Portal, making it easy for taxpayers to take their compliance into the modern age.

Buydscdelhi.com is an online digital signature portal (A Unit of Digital Signature Mart). Buydscdelhi.com allows users to buy digital signature class 2, class 3 & DGFT certificates in Delhi & Ncr – India. we provide free delivery at your doorstep. You can reach your digital signature certificate within 24 hours at your doorstep. Our online 24×7 support team helps you to purchase a digital signature and help you to any problem related to the digital signature certificate. Need a digital signature? – Call us +91 8883913333.

Comments

No comment yet.